#### The Rise of Cryptocurrency

In recent years, cryptocurrency has emerged as a revolutionary force in the financial landscape. Traditional banking systems have been challenged by the advent of cryptocurrencies like Bitcoin, Ethereum, and many altcoins. Cryptocurrencies leverage blockchain technology to enable secure, decentralized transactions, allowing individuals to take control of their finances without the need for intermediaries. This has the potential to significantly reduce transaction costs and increase access to financial services for unbanked populations around the world.

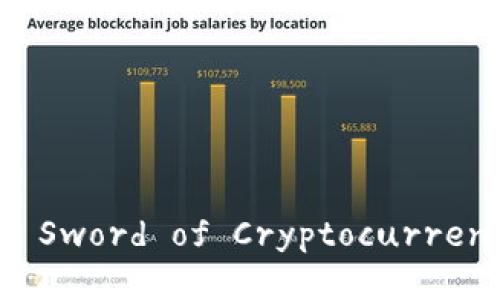

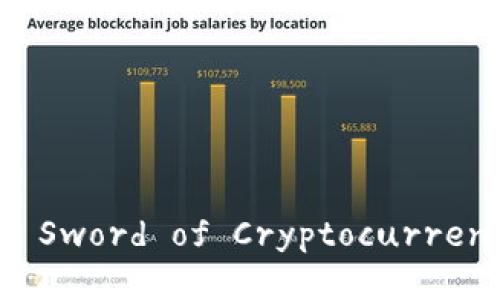

However, cryptocurrency is not without its challenges. Issues such as volatility, regulatory concerns, and security risks make it a double-edged sword. While it offers unprecedented financial innovation and autonomy, it also carries the potential for misuse and exploitation. Understanding the implications of cryptocurrency requires a nuanced approach, considering both its benefits and its pitfalls.

#### The Mechanism Behind Cryptocurrency

At its core, cryptocurrency operates on blockchain technology, a decentralized ledger that records all transactions across a network of computers. This ensures that all transactions are transparent and immutable, meaning they cannot be altered once recorded. The security of blockchain comes from cryptographic techniques that protect the integrity of the data.

Miners, or individuals who use powerful computers to solve complex mathematical problems, are incentivized with rewards in the form of new coins for validating transactions. This process not only secures the network but also introduces new currency into circulation. As more people and businesses adopt cryptocurrency, the demand for these digital assets increases, leading to price fluctuations that can be both advantageous and detrimental to investors.

#### Advantages of Cryptocurrency

1. **Decentralization**: One of the most significant advantages of cryptocurrency is its decentralization. Traditional financial systems are often controlled by central banks and governments, leading to potential overreach and mismanagement. Cryptocurrencies, on the other hand, operate on a peer-to-peer network, eliminating centralized control and providing individuals with more autonomy over their finances.

2. **Lower Transaction Fees**: Cryptocurrency transactions typically come with lower fees compared to traditional banking systems. This is particularly beneficial for cross-border transactions, where traditional banks often charge high fees and take several days to process. Cryptocurrencies can facilitate near-instantaneous transactions at a fraction of the cost.

3. **Access for the Unbanked**: In many developing countries, millions of people lack access to basic banking services. Cryptocurrency can provide an alternative means for these individuals to enter the financial system. With just a smartphone and internet access, they can engage in transactions, store value, and even participate in investment opportunities.

4. **Security and Privacy**: Cryptocurrencies offer enhanced security features through cryptography. Users can maintain a degree of anonymity, protecting their financial information from potential breaches associated with traditional banking systems. Transactions made with cryptocurrencies are also hard to trace back to individuals, providing a layer of privacy that many users value.

#### Disadvantages of Cryptocurrency

1. **Volatility**: One of the most significant drawbacks of cryptocurrency investment is its extreme volatility. Prices can fluctuate dramatically within short periods, leading to substantial gains or losses. This volatility can deter investors looking for stable investment options and complicates its use as a currency for everyday transactions.

2. **Regulatory Uncertainty**: The regulatory landscape surrounding cryptocurrency is still developing. Many governments are grappling with how to classify and regulate cryptocurrencies, leading to uncertainty for investors and users. Some countries have imposed strict regulations or outright bans on cryptocurrency transactions, which can stifle innovation and hinder adoption.

3. **Security Risks**: While blockchain technology is inherently secure, individual users can be exposed to risks such as hacking, phishing, and scams. Numerous high-profile hacks have resulted in the loss of millions of dollars worth of cryptocurrency. Users must take precautions, such as using secure wallets and practicing safe online behavior, to protect their assets.

4. **Environmental Concerns**: The process of mining cryptocurrencies, particularly Bitcoin, requires significant energy resources. The environmental impact of large-scale mining operations has raised concerns about their sustainability. Critics argue that the energy consumption associated with cryptocurrency mining can contribute to climate change and environmental degradation.

#### Potential Related Questions

1. **What is cryptocurrency mining and how does it work?**

2. **How do cryptocurrencies differ from traditional currencies?**

3. **What are the risks and benefits of investing in cryptocurrency?**

4. **How is cryptocurrency regulated globally?**

5. **What is the future outlook for cryptocurrency and blockchain technology?**

### Question 1: What is cryptocurrency mining and how does it work?

#### Understanding Cryptocurrency Mining

Cryptocurrency mining is the process by which transactions are verified and added to the public ledger (blockchain) and is also the method through which new coins are created. Miners use powerful computers to solve complex mathematical problems that validate transactions occurring on the network.

### How Mining Works

When a user initiates a transaction using cryptocurrency, it is grouped with other transactions into a "block." Miners then compete to solve a cryptographic puzzle that allows them to add the block to the blockchain. The first miner to solve the puzzle broadcasts the solution to the network, and if verified by other miners, the block is added to the chain.

Additionally, miners are rewarded for their efforts. In the case of Bitcoin, miners receive a set number of bitcoins for each block they successfully mine. This incentivizes miners to continue participating in the network and secures the blockchain against fraud.

### Proof of Work vs. Proof of Stake

Cryptocurrency mining commonly involves two consensus mechanisms: Proof of Work (PoW) and Proof of Stake (PoS).

**Proof of Work (PoW):** This method requires miners to solve complex mathematical puzzles, consuming significant computational power and energy. Bitcoin operates on this model, which has drawn criticism for its environmental impact.

**Proof of Stake (PoS):** This alternative method selects validators based on the number of coins they hold and are willing to "stake" as collateral. This approach is considered more energy-efficient and is utilized by cryptocurrencies like Ethereum 2.0.

### The Future of Mining

As more cryptocurrencies move towards PoS and other energy-efficient mechanisms, the landscape of mining is likely to evolve. However, for PoW-based cryptocurrencies, the challenge of energy consumption and environmental impact will continue to generate discourse, especially as the global community focuses on sustainability.

### Question 2: How do cryptocurrencies differ from traditional currencies?

#### Understanding Currency

To appreciate the differences between cryptocurrencies and traditional (fiat) currencies, it's crucial to understand the fundamental nature of money itself. Traditional currencies, such as the US dollar or euro, are issued by governments and regulated by central banks. They derive value from trust in the issuing authority and the economic stability of the nation.

### Core Differences

1. **Centralization vs. Decentralization:** Traditional currencies are centralized and controlled by governments or central banks, which can influence their value through monetary policy. In contrast, cryptocurrencies operate on decentralized networks and are not subject to control by any single entity.

2. **Digital vs. Physical:** While traditional currencies exist in physical forms (banknotes and coins), cryptocurrencies exist only in digital form. This allows for faster transactions and reduced costs but raises concerns over security and reliability.

3. **Supply Control:** Traditional currencies can be printed or minted at will by governments, potentially leading to inflation. Cryptocurrencies often have a capped supply (e.g., Bitcoin's maximum supply is 21 million) to ensure scarcity and prevent inflation.

4. **Transaction Verification:** Traditional transactions often require intermediaries, such as banks, to verify and authorize payments, which can be slow and costly. Cryptocurrencies enable peer-to-peer transactions, with verification handled by the decentralized network, allowing for quicker and cheaper transfers.

5. **Anonymity and Privacy:** While traditional banking systems often require users to provide personal information for identification, cryptocurrencies can offer a level of anonymity. Users can transact without revealing their identity, which can be advantageous but also raises concerns regarding illicit activities.

### The Role of Trust and Stability

The stability of traditional currencies is backed by the economic strength of the issuing country. In contrast, cryptocurrencies rely primarily on market demand, technological reliability, and user trust. This means cryptocurrencies can be highly volatile, with prices influenced by market speculation, regulatory news, and technological advancements.

### Question 3: What are the risks and benefits of investing in cryptocurrency?

#### Evaluating the Investment Landscape

Investing in cryptocurrency can be alluring due to the potential for high returns. However, it comes with significant risks that investors should understand before entering the market.

### Benefits of Investing in Cryptocurrency

1. **High Returns:** The most compelling reason to invest in cryptocurrency is the prospect of substantial returns. Early investors in Bitcoin and other cryptocurrencies have seen exponential growth in their investments, often outperforming traditional asset classes.

2. **Diversification:** Cryptocurrencies can serve as an alternative investment, potentially reducing portfolio risk and providing diversification benefits. They often have a low correlation with traditional markets, which may protect investments during economic downturns.

3. **Access to New Opportunities:** The cryptocurrency market offers a variety of investment opportunities beyond just direct investment in coins. Investors can explore decentralized finance (DeFi), non-fungible tokens (NFTs), and other innovations that can offer unique returns.

### Risks of Investing in Cryptocurrency

1. **Volatility:** As previously mentioned, cryptocurrency is known for its dramatic price swings. Investors can experience large fluctuations in their portfolio value, leading to significant financial stress.

2. **Regulatory Risk:** The evolving regulatory landscape poses risks for crypto investors. Governments around the world are still figuring out how to regulate cryptocurrencies, which can lead to sudden legal changes that might affect investment value.

3. **Security Concerns:** The risk of hacking, scams, and fraud remains a critical issue in the cryptocurrency world. Investors must exercise caution and implement robust security measures to protect their holdings.

4. **Market Maturity:** The cryptocurrency market is still relatively immature, and investor sentiment can swing dramatically based on news, events, or market trends. This can create unpredictable and irrational market behavior.

### Conclusion

Investing in cryptocurrency can be a thrilling journey that offers remarkable opportunities but comes with inherent risks. Investors must conduct thorough research, adopt sound risk management strategies, and be prepared for the inherent volatility associated with the market.

### Question 4: How is cryptocurrency regulated globally?

#### The Evolving Regulatory Landscape

Cryptocurrency regulation varies significantly from country to country, reflecting different perspectives on the role of digital currencies in the economy. Some nations fully embrace cryptocurrency, while others impose strict regulations or outright bans due to concerns about fraud, money laundering, and potential threats to financial stability.

### Global Approaches to Regulation

1. **United States:** In the US, the regulatory landscape is fragmented. While cryptocurrencies are classified as "digital assets," different states and federal agencies have distinct approaches. The Securities and Exchange Commission (SEC) considers some cryptocurrencies as securities, subjecting them to securities laws. The Commodity Futures Trading Commission (CFTC) regulates cryptocurrency derivatives trading. Regulatory clarity is still evolving, impacting the market.

2. **European Union:** The EU has taken a proactive approach to cryptocurrency regulation. The proposed Markets in Crypto-Assets (MiCA) Regulation aims to provide a comprehensive framework that protects investors and fosters innovation. EU member states have varying regulatory stances; some are more permissive, while others employ strict measures to control risks.

3. **Asia:** Countries in Asia exhibit diverse regulatory approaches. For instance, Japan has implemented a licensing system for cryptocurrency exchanges, promoting transparency and consumer protection. Conversely, China has imposed strict bans on cryptocurrency trading and Initial Coin Offerings (ICOs), citing concerns over financial stability and speculation.

4. **Middle East and Africa:** The regulatory landscape in the Middle East and Africa is also mixed. Nations like the United Arab Emirates have cultivated a favorable environment for cryptocurrency businesses, recognizing their potential for growth. However, many African countries face challenges related to regulation, as digital currencies emerge in regions with limited financial infrastructure.

### The Need for Global Cooperation

Uniformity in cryptocurrency regulations is still lacking, which can create challenges for cross-border transactions and investment. As cryptocurrencies gain mainstream acceptance, regulatory bodies worldwide must collaborate to establish standards that address concerns while promoting innovation.

### Conclusion

The regulatory landscape governing cryptocurrency continues to evolve. Investors, developers, and businesses operating in the space must stay up-to-date with global regulations to navigate this complex environment effectively.

### Question 5: What is the future outlook for cryptocurrency and blockchain technology?

#### Assessing the Future of Cryptocurrency

The future of cryptocurrency and blockchain technology is a frequent topic of discussion among investors, tech enthusiasts, and policymakers. While the market has faced challenges, several indicators point towards a promising future for these innovations.

### Increasing Mainstream Adoption

1. **Institutional Investment:** More institutional investors are recognizing the potential of cryptocurrencies, contributing to mainstream adoption. Companies like Tesla and Square have incorporated Bitcoin into their balance sheets, signaling a shifting perspective on digital assets.

2. **Expanded Use Cases:** The applicability of blockchain technology goes beyond financial transactions. Industries like supply chain management, healthcare, and even voting systems are exploring blockchain for its transparency, security, and efficiency. As use cases expand, further investment and innovation are likely to follow.

3. **Central Bank Digital Currencies (CBDCs):** Many central banks worldwide are exploring the development of CBDCs, which could legitimize the role of digital currencies and reshape traditional financial systems. Countries like China have already launched pilot programs for their digital yuan.

### Overcoming Challenges

While optimistic about the future, several challenges must be addressed:

1. **Scalability:** Achieving scalability without compromising security is crucial for mass adoption. Innovations like the Lightning Network for Bitcoin and Ethereum 2.0's shift to PoS aim to enhance transaction throughput and reduce fees.

2. **Environmental Concerns:** The environmental impact of cryptocurrency mining has drawn scrutiny. Developing eco-friendly consensus mechanisms and improving energy efficiency in mining operations will be essential for sustainable growth.

3. **Regulatory Clarity:** A clear regulatory framework will further legitimize cryptocurrency and blockchain technology, attracting more investors and innovators. Collaboration between governments and industry stakeholders will facilitate this process.

### Conclusion

The future of cryptocurrency and blockchain technology is poised for growth, driven by increasing adoption, innovative use cases, and institutional interest. Although challenges exist, ongoing developments suggest a landscape where digital currencies and decentralized technologies become integral to our financial and social systems.

### Final Thoughts

In summary, cryptocurrency represents both an opportunity and a challenge in the modern financial landscape. By understanding its mechanisms, benefits, risks, and regulatory environment, individuals can make informed decisions while navigating this ever-evolving space. The future of cryptocurrency may be uncertain, but its potential for innovation remains an exciting frontier for investors, developers, and policymakers alike.